Union Bank Fixed Deposit Rates

Posted By admin On 06/07/22Jun 27, 2019 Higher deposits and longer maturity are offered higher interest rates. We have listed the top 5-time deposit accounts in the Philippines as of June 24, 2019. The least comparable amount for the following banks is PHP 100,000 whose row is highlighted in green. City Union Bank (CUB) FD Calculator: Get details on City Union Bank (CUB) FD rates on March.

- Union Bank Fixed Deposit Rates 2020

- Union Bank Nre Fixed Deposit Rates

- Bank Fixed Deposit Rates In India

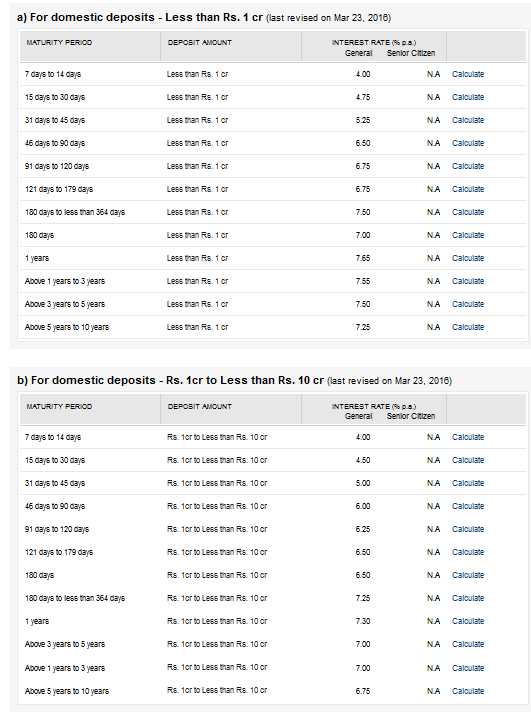

City Union Bank Fixed Deposit Rate. Fixed deposits are popular investment avenues, it is also the most sought-after avenue by investors. A single individual can hold multiple deposit account with same or different banks, the term deposits would vary typically based on term and interest rates. In case of Pre-closure of retail term deposits (less than Rs.2.00 crores), which have run for 7 days or above, interest to be paid at 1.00% less than the applicable rate (as on the date of opening of deposit) for the period for which it has actually remained with the Bank or contracted rate. Union Bank of India Fixed Deposit Interest Rates for Senior Citizens Senior Citizens are entitled to an additional interest rate for term deposits of one year and more. The additional interest rate offered by Union Bank of India is 0.50% over the normal rate.

| You are here : | Products Personal Fixed deposit |

Fixed Deposit Receipt (FDR)

Features:

Union Bank Fixed Deposit Rates 2020

Scheme Code | TD002 |

Eligibility | Any Resident Individual - Single Accounts, Two or more individuals in Joint Accounts, Illiterate Persons, Blind persons, Purdanasheen Ladies, Minors, Associations, Clubs, Societies, etc. Trusts, Institutions/Agencies specifically permitted by the RBI eligible to open a 'Fixed Deposit Receipt' Account' in single/joint names. |

Minimum Period | 6 Months |

Maximum Period | 120 months |

Minimum Deposit Amount | Rs.1000/- . |

Maximum Deposit | No Limit |

Rate of Interest | The rate of interest is payable on fixed deposit receipt as per interest table available on the Bank’s website. |

Interest payment Frequency | Interest will be paid on quarterly or half yearly basis as per the instruction of the customer. In case date of interest payment falls on a holiday the same will be paid on the next working day. |

TDS | TDS will be deducted as per guidelines. |

Loan Facility | Available |

Nomination Facility | Available as per guidelines |

Automatic Renewal | Deposit will be auto renewed for the same period at the applicable rate of interest on maturity in the absence of specific instruction. |

Premature Closure | Allowed. Interest will be paid for the run period at applicable rate and penalty if any. |

Penalty on Premature Closure | In case of Pre-closure of retail term deposits (less than Rs.2.00 crores), which have run for 7 days or above, interest to be paid at 1.00% less than the applicable rate (as on the date of opening of deposit) for the period for which it has actually remained with the Bank or contracted rate, whichever is lower. |

Union Bank Nre Fixed Deposit Rates

UNION BANK OF INDIA RESERVES THE RIGHT TO CHANGE / ALTER / WITHDRAW TERMS AND CONDITIONS OF THE SCHEME.

- Apply Online

- Fixed Deposits