Cd Finance

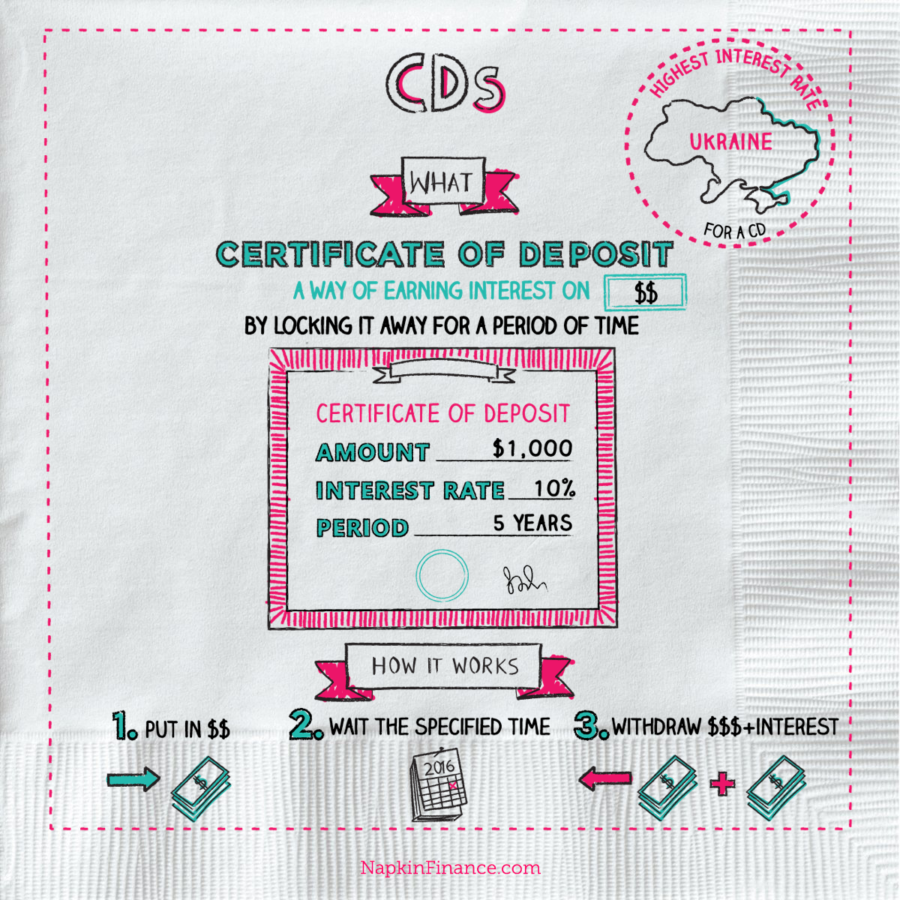

Posted By admin On 23/07/22A certificate of deposit is known as a CD and is used by consumers to save money for longer periods of time. A CD is a safe method to save money because up to $250,000 of the money allocated into.

© MoMo Productions/Getty Images Mother working on laptop with daughter nearbyCertificates of deposits (CDs) are safe vehicles for investors hoping to avoid taking on too much risk. If you keep your funds locked up in the bank for an entire term (such as three months or one year), you can expect to end up with your initial deposit plus interest.

Popular Searches

Savings Accounts Getting you to where you want to be. The financial future you’ve always dreamed of starts with saving. Easily open an account with us online to get top-notch rates you won’t find anywhere. A CD is a type of deposit account that offers a fixed interest rate in exchange for keeping your funds in the account for a certain period of time.

A 12-month CD won't pay the highest CD rates in the market. But right now, there isn't much of a difference between the annual percentage yields (APYs) on many one-year CDs and five-year CDs. The benefit to a short-term CD, such as a one-year CD is when your account comes due, you'll have an opportunity to see if a higher-yielding option is available.

Calculate how much interest you can earn using Bankrate's calculator, and use that information to compare offers to see what works best for you.

Summary of Best 1-year CD rates for March 2021

- Quontic Bank CD: 0.65% APY

- Live Oak Bank CD: 0.65% APY

- Comenity Direct CD: 0.63% APY

- Ally Bank CD: 0.60% APY

- BrioDirect CD: 0.60% APY

- First Internet Bank of Indiana CD: 0.60% APY

- Limelight Bank CD: 0.60% APY

- Amerant Bank CD: 0.60% APY

- Synchrony Bank CD: 0.55% APY

- Marcus by Goldman Sachs CD: 0.55% APY

- Radius Bank CD: 0.50% APY

- TIAA Bank CD: 0.50% APY

- Discover Bank CD: 0.50% APY

Note: The APYs (Annual Percentage Yields) shown are as of Feb. 26, 2021. Bankrate's editorial team updates this information regularly, typically biweekly. APYs may have changed since they were last updated. The rates for some products may vary by region.

Bankrate’s guide to choosing the right cd rate

Why you can trust Bankrate

Bankrate has more than four decades of experience in financial publishing, so you know you're getting information you can trust. Bankrate was born in 1976 as 'Bank Rate Monitor,' a print publisher for the banking industry and has been online since 1996. Hundreds of top publications rely on Bankrate. Outlets such as The Wall Street Journal, USA Today, The New York Times, CNBC and Bloomberg depend on Bankrate as the trusted source of financial rates and information.

Methodology for Bankrate’s Best CD Rates

At Bankrate, we strive to help you make smarter financial decisions. We follow strict guidelines to ensure that our editorial content is unbiased and not influenced by advertisers. Our editorial team receives no direct compensation from advertisers and our content is thoroughly fact-checked to ensure accuracy.

Bankrate regularly surveys around 70 widely available financial institutions, made up of the biggest banks and credit unions, as well as a number of popular online banks.

To find the best CDs, our editorial team analyzes various factors, such as: APY, the minimum needed to earn that APY (or to open the CD) and whether or not it is broadly available. All of the accounts on this page are insured by Federal Deposit Insurance Corp. (FDIC) banks or by the National Credit Union Share Insurance Fund (NCUA) at National Credit Union Administration (NCUA) credit unions.

When selecting the best CD for you, consider the purpose of the money and when you'll need access to these funds to help you avoid early withdrawal penalties.

Top banks offering 12-month CD rates for March 2021

Quontic Bank: 0.65% APY, $500 minimum deposit

Quontic Bank was established in 2005 and has its headquarters in New York. Quontic Bank calls itself the Adaptive Digital Bank.

You only need $500 to open a Quontic Bank CD. Quontic Bank offers five terms of CDs, ranging from one year to five years.

In addition to its CDs, Quontic Bank also has a money market account, a high-yield savings account and two checking accounts.

Considering the yield and minimum deposit, Quontic Bank’s one-year CD is one of the best offers available for this CD term.

Live Oak Bank: 0.65% APY, $2,500 minimum deposit

Live Oak Bank offers six terms of CDs. The shortest-term CD is the six-month CD and the longest-term CD is a five-year CD.

These CDs all have a $2,500 minimum deposit requirement. The bank also offers an online savings account, which doesn't have a minimum balance requirement.

Comenity Direct: 0.63% APY, $1,500 minimum deposit

Comenity Direct launched in April 2019. It's an online-only bank that offers high-yield savings products and CDs. Comenity Direct offers five terms of CDs.

Comenity Direct is a brand of Comenity Capital Bank. Comenity Capital Bank is a brand that's existed for around 30 years. Comenity is the bank behind many popular branded credit cards.

Ally Bank: 0.60% APY, $0 minimum deposit

Ally Bank is an online-only bank that has been around for a little more than 10 years. Its CDs have competitive APYs and few require a minimum deposit.

The bank offers several different types of CDs. In addition to its standard CDs, it has a raise your rate CD and a no-penalty CD. The raise your rate CD allows the interest rate to increase once with the two-year CD or twice with the four-year CD if the balance tier increases on your CD.

Ally Bank's early withdrawal penalties are less harsh than those that apply at most other banks. For example, the penalty applying to CDs maturing in five years is 150 days of interest (usually it's equal to at least 180 days of interest).

BrioDirect: 0.60% APY, $500 minimum deposit

BrioDirect is Sterling National Bank's online brand. All BrioDirect savings deposit products are provided by Sterling National Bank, which was founded in 1888.

BrioDirect only offers CDs and a high-yield savings account. Both of these savings products offer a competitive yield.

BrioDirect gives customers a variety of CDs to choose from since it offers 13 different terms - starting with 30 days and going out to five years. Even with this range of terms, the one-year CD is one of the best deals and has the highest APY for a CD at BrioDirect.

First Internet Bank of Indiana: 0.60% APY, $1,000 minimum deposit

First Internet Bank of Indiana was the first FDIC-insured financial institution to operate entirely online, according to the bank's website. First Internet Bank of Indiana opened in 1999 and is available in all 50 states.

First Internet Bank offers eight terms of CDs, a money market savings account with a competitive yield, a savings account and two checking accounts.

Limelight Bank: 0.60% APY, $1,000 minimum deposit

Limelight Bank is a division of Capital Community Bank, with headquarters in Provo, Utah. Limelight Bank calls itself a conscientious bank that actively ties its business to eco-friendly initiatives. Savings deposits at Limelight Bank turn into loans for solar projects, according to its website.

Limelight Bank only offers CDs on its website.

Amerant Bank: 0.60% APY, $10,000 minimum deposit

Amerant Bank offers a competitive yield on its one-year CD. Amerant Bank has 26 banking centers - 18 in South Florida and eight in Houston.

However, the Amerant Bank CD yield mentioned here isn’t available in Florida and Texas. Plus, the high minimum amount to get that APY is $10,000, which may be a tough requirement for some savers to meet.

Synchrony Bank: 0.55% APY, $0 minimum deposit

Synchrony Bank has many CD terms to choose from. Synchrony Bank's 12 terms of CDs range from a three-month CD to a five-year CD.

Unlike the CDs, which have a $2,000 minimum deposit requirement, Synchrony Bank's high-yield savings account and money market account don't require a minimum balance.

Marcus by Goldman Sachs: 0.55% APY, $500 minimum deposit

Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA. Marcus offers nine terms of CDs, three no-penalty CD terms and a savings account.

The CDs require a $500 minimum to open one, but Marcus' savings account doesn't require a minimum deposit.

Radius Bank: 0.50% APY, $500 minimum deposit

Radius Bank is a digital bank that offers nine terms of CDs. But currently, only the one-year CD, 18-month CD and the three-year CD are available online.

It also offers checking accounts and savings accounts.

TIAA Bank: 0.50% APY, $1,000 minimum deposit

TIAA Bank Basic CDs give you an alert 20 days before the CD matures. They range in terms from three months to five years and require a $1,000 minimum deposit to open one.

TIAA Bank is a division of TIAA, FSB. TIAA Bank had 10 financial centers as of March 2020, all located in Florida.

Discover Bank: 0.50% APY, $2,500 minimum deposit

Discover Bank may be known for its credit cards. But it also offers a wide selection of banking products. It has been offering deposit products online since 2007.

Discover Bank offers CDs ranging in terms as short as three months to 10 years. It also offers a checking account, money market account and a savings account.

Compare no-penalty CDs

Traditional CDs typically come with early withdrawal penalties that can significantly reduce your earnings. To avoid forfeiting interest for closing out your account before the term officially ends, consider looking for liquid or no-penalty CDs. A no-penalty CD might be a good option during uncertain times. This applies to both the uncertainty of the economy due to coronavirus and the uncertainty of future rates.

Just keep in mind that the yields associated with no-penalty CDs tend to be lower than the rates tied to traditional CDs.

The following four banks offer no-penalty CDs:

- Ally Bank: 11 months; 0.50% APY, $0 deposit to earn top APY

- Marcus by Goldman Sachs: 7-13 months; 0.25% APY - 0.45% APY, $500 minimum deposit (7-month CD is 0.45% APY.)

- CIT Bank: 11 months; 0.30% APY, $1,000 minimum deposit

- PurePoint Financial: 11-14 months; 0.10% APY - 0.15% APY, $10,000 minimum deposit (11-month CD is 0.15% APY.)

Coronavirus and Your Money

The COVID-19 pandemic is deepening financial hardships for millions of Americans.

While CD rates are not likely to rise in this environment, their stability can offer some comfort to those who still have extra cash on hand. The rate on a CD stays the same during the deposit term and the account holder knows exactly when that term will end. With their locked-in interest rates, CDs are also a great choice to avoid the stock market's ups and downs.

1-year CD FAQs

What is a 1-year CD?

Having a 1-year CD means that your savings will be tied up for 12 months. Generally, you won't be able to access your funds during that period of time (unless you don't mind getting hit with an early withdrawal penalty). In exchange, you'll earn a higher yield than you would from a standard savings account or money market account.

Who should open a 1-year CD?

If you're not planning to touch your money for a year and believe the benefits of a 1-year CD are more attractive than the yield associated with a liquid savings account, then it's a good time to consider getting a 1-year CD. And if you're constantly dipping into your savings, a 1-year CD could help you save more money.

Today's top nationally widely available 1-year CD pays 0.65 percent APY. That's not enough to retire on, but it's a good vehicle to meet short-term financial obligations (like saving for a down payment on a mortgage) that can let your money grow near the rate of inflation without having to worry about missing out on better deals that arrive after you invest.

How CD rates work

Banks and credit unions set their own CD rates based on multiple factors, including inflation, and the rates set by competitors. Changes in treasury yields and Federal Reserve interest rate decisions are taken into account as well.

Some banks have a 10-day best rate guarantee, meaning you could end up with a better rate if the bank raises theirs within days of your decision to open and fund your account. But generally, once you open and fund a fixed-rate CD, you're stuck with that APY until your term ends. Over time, the bank may raise or lower the advertised rate for new account holders, but your rate will remain the same.

If you do your research, you'll find that some institutions offer bump-up or step-up CDs that allow rates to change either upon request or at certain intervals during the term. Rates for these CDs, however, tend to be lower than those tied to fixed-rate CDs.

When reviewing CD rates, pay close attention to the APY. The APY includes the effects of compounding. Compound interest is the interest you earn on interest.

Calculate how much interest you'll earn as you compare APYs.

Right now, average CD rates remain at historic lows. However, if you shop around, you can find better deals than what's offered by the primary bank managing your checking account. Researching rates at several local banks, as well as reputable online banks, will usually yield the best rate.

Can you lose money with a 1-year CD?

As long as you choose a 1-year CD with a fixed rate - and keep the funds in the CD for the duration of the term - you won't lose money. If you withdraw before the term of the CD allows, you may be subject to an early withdrawal penalty.

Also, each depositor at a Federal Deposit Insurance Corp. (FDIC) bank is insured to at least $250,000 per FDIC-insured bank. According to FDIC.gov, no depositor has lost a single cent on FDIC-insured funds as a result of a bank failure. If you're concerned about your FDIC insurance eligibility, you can use the FDIC's Electronic Deposit Insurance Estimator.

The standard share insurance amount is $250,000 per share owner, per insured credit union, for each ownership category at National Credit Union Administration (NCUA) institutions.

It's also important to factor in inflation. If the rate of inflation is higher than your CD yield, your purchasing power goes down.

1-year CD vs. other investment accounts

Before you buy a 1-year CD, it's important to find out how it stacks up against other types of investment vehicles. Read on to find out how 1-year CDs compare to more liquid accounts, like savings accounts and money market accounts.

1-year CD vs. savings account

CDs with terms lasting for one year often pay more interest than traditional savings accounts. Here's why: You're rewarded with a higher yield in exchange for agreeing to leave your money tied up for a set period of time.

What's more, if you keep money locked up in a CD, it's harder to access those savings. With a liquid savings account, there is usually no consequence for withdrawing funds (unless you make more than six withdrawals or transfers per statement cycle). Since your CD may have an early withdrawal penalty, you'll probably think twice about raiding your savings.

Another benefit 1-year CDs have over savings accounts is the guaranteed rate that applies for the full term. Savings account rates can change at any time as a result of changes in an interest rate environment or a bank's priorities. That means over time, your rate of return could decline.

Note that there are downsides to choosing a 1-year CD over a savings account. Because CDs traditionally are not liquid accounts, it's best to keep your emergency fund in a savings account. That way, you can easily access the funds you need to cover an unexpected expense without paying a penalty. Additionally, just as savings account interest rates can go down, they can also go up. By locking your money up in a CD, you could miss out on an opportunity to earn more interest.

1-year CD vs. money market account

Another option is parking your cash in a money market account. At some banks, the money market account requires a higher minimum deposit and pays more interest than the institution's savings account.

Compared to money market account rates, however, 1-year CD rates tend to be higher. In many cases, you can qualify for one of the top 12-month CD deals without having to fork over a large amount of cash. At banks with a tiered interest rate structure, you may have to deposit more money to earn the top money market account rate.

Like savings accounts, money market accounts are worth considering if you're not interested in tying up money for months or years at a time. You can easily withdraw your savings at any time without penalty, and at some banks, you'll have access to a debit card. Keep in mind that money market accounts are usually limited to a maximum of six convenient transfers or withdrawals per month or per statement cycle because of Regulation D. There may be a fee for exceeding this limit.

1-year CD vs. a 5-year CD

While a 5-year CD might have a higher APY, a shorter-term CD can be a better option. CD rates could change significantly in a year and you might not want to miss out on a good deal. Given the current interest rate environment, however, going with a long-term CD like a 4-year or 5-year CD doesn't make sense for many people.

Carefully weigh the pros and cons, and consider using a CD laddering strategy to take advantage of different CD term lengths.

Here are the best 1-year CD rates for March 2021

| Financial Institution | 1-Year APY | Minimum Deposit for APY | Learn More |

|---|---|---|---|

| Quontic Bank | 0.65% | $500 | Read review |

| Live Oak Bank | 0.65% | $2,500 | Read review |

| Comenity Direct | 0.63% | $1,500 | Read review |

| Ally Bank | 0.60% | $0 | Read review |

| BrioDirect | 0.60% | $500 | Read review |

| First Internet Bank of Indiana | 0.60% | $1,000 | Read review |

| Limelight Bank | 0.60% | $1,000 | Read review |

| Amerant Bank | 0.60% | $10,000 | Read review |

| Synchrony Bank | 0.55% | $0 | Read review |

| Marcus by Goldman Sachs | 0.55% | $500 | Read review |

| Radius Bank | 0.50% | $500 | Read review |

| TIAA Bank | 0.50% | $1,000 | Read review |

| Discover Bank | 0.50% | $2,500 | Read review |

Learn more about other CD terms:

Banks usually offer CDs across multiple terms. Depending on the institution, you may have the option of choosing an account maturing in less than a year. There are also CDs that mature in as many as 10 years.

Carefully consider your financial goals and needs. Weigh your options and make an informed decision about what CD is right for you. You might be perfectly fine with a short-term, 1-year CD. Or you may find that you're better off opting for an account with a longer term.

Advertiser DisclosureCertificates of deposit, or CDs, are powerful, interest-bearing investments that reward investors for leaving cash untouched for a fixed period of time. A CD calculator can help you to know how much you can expect to make on your investment and how much to invest to reach your financial goal.

How to calculate CD earnings

Using a CD calculator is simple. Input the basic information about the CD option you're looking at, and click the calculate button. The information you'll need is your initial deposit size, how long the CD is invested for and the APY rate offered.

You can compare different scenarios by changing out these numbers to see the effects it will have on your total ending balance, interest earnings, total earnings and how that matches up against the current national average.

- Initial deposit: The amount of money you initially invest in your CD

- Period (months and years): The time period that your CD is for. This is the period of time you're expected to leave your funds untouched to get maximum gains.

- APY: The annual percentage yield (APY) is the percentage rate of return you'll see over the course of one year. APY, as opposed to the interest rate, does take into account the effects of compound interest.

- Total balance: The amount you should have available for withdrawal at the end of your CD investment term.

- Interest earnings: The portion of your earnings that come from interest

- Your earnings: The total earnings you'll see at the end of your CD term, including interest and the effects of compounding

- National average: The amount you would earn with a CD that mirrored the current national average rate of return

Cd Finance Calculator

Why use a CD calculator

As long as you're getting a CD through a trusted banking partner that is FDIC insured or NCUA insured, the major difference between options will be the rate of return. CD calculators allow you to quickly determine how much you're going to make with a particular CD option. If you're looking to meet a particular savings goal, a CD calculator lets you quickly change period lengths, deposit amounts and APY rates to find the right option.

How to pick the best CD provider

The first thing you should look for when selecting a CD provider is whether it is FDIC- or NCUA-insured or not. You will want to stick to investing in financial institutions that have government backing of the funds.

From there, you'll want to look at the APY rates to see where you might get the best return. Remember, APY rates will vary based on the term of the CD and also may vary based on the amount of money you have invested. Always take the time to compare the best CD rates to make sure that you're locking your money into the right account.

Cd Finance China

Lastly, make sure you look at the early withdrawal penalties. Not all institutions assess the same penalties. Ideally, you'll keep the money in the CD until maturity, but it's good to know what will happen if you find a sudden need for the money.

What happens if you withdraw early

Unless you're taking advantage of a no-penalty CD like the ones offered through Ally Bank, you will incur an interest penalty if you withdraw your funds early. The idea of a CD is that the bank knows it can use your funds for different operations during the fixed period. When you withdraw early, the bank will assess a penalty because of this.

Different financial institutions will have different withdrawal penalties. For example, Alliant Credit Union will take back the interest earned up to 120 days for a CD that is open 18 to 23 months. Ally Bank will only take up to 60 days of interest for CDs 24 months or less. Keep in mind that the bank or credit union won't take any of your initial deposit as a penalty.